12 Ways to Stick to Your Budget and Avoid Impulse Spending

A dazzling pair of shoes, the latest smartphone, or a spontaneous weekend getaway, all these can often lure us into the sphere of impulse spending, jeopardizing our long-term financial health. Understanding impulse spending and its triggers, and realizing the relationship between emotions and impulsive buying are the first steps towards curbing this habit. Paired with creating a practical budget that matches one’s income and expenditure, it forms the foundation for wise financial decisions.

*This post contains affiliate links. That means that if you make a purchase after clicking on a link I may earn a small commission at no extra cost to you. For more information, click here.

Budgeting doesn’t have to be boring or overwhelming. It can be innovatively managed with the use of tech tools and enlightened with the practice of mindfulness tactics. These tools not only help monitor and control spending but also align it with personal financial goals, paving the way for a bright financial future.

Making money do what we want it to do is a skill, and developing healthy money habits is of utmost importance. Sometimes, embracing minimalism could be the key to unlock a stress-free financial life.

Understanding Impulse Spending

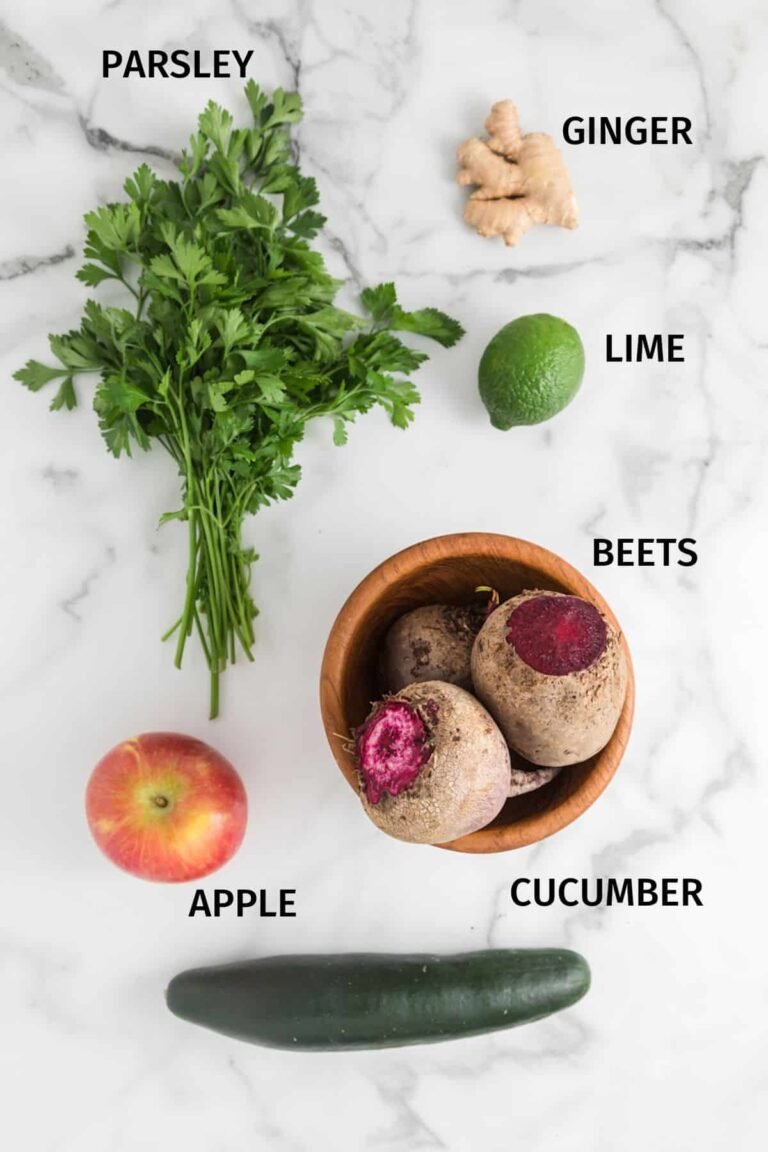

Impulse spending refers to unplanned purchases made on a whim. These are purchases that weren’t accounted for in a budget, and are driven by an immediate desire or emotion to own something. An interesting take on this can be found on minimizemymess.com, where the relationship between impulse purchases and emotional spending is discussed in detail.  Image courtesy of minimizemymess.com

Image courtesy of minimizemymess.com

- Triggers for impulse spending often relate to emotional states, like being bored, happy, or stressed.

- Impacts of impulsive spending on financial health can be dramatic, leading to debt and a lack of savings.

- It’s important to identify personal impulse spending patterns and recognize warning signs like emotional distress or a habit of reward shopping.

Creating a Practical Budget

Creating a realistic budget is the first step in getting financial control. It involves understanding your income and expenditure, prioritizing different expense categories, and setting aside an amount for discretionary spending.

-

- Understanding your income involves keeping track of all sources of money, including your salary, any freelance work, investmments, and gifts.

- Prioritizing expenses means identifying essential categories like housing and utilities, and non-essential categories like entertainment and shopping.

- Allocating a set amount for discretionary spending can help curb impulse shopping while allowing room for enjoyment.

- Monitoring and adjusting the budget is essential to staying on track.

- Stretch your budget further with Weltbild.de! They’re having a massive sale right now: Sale Save up to 80% off at Weltbild. That’s right, you can find incredible deals on everything from books and electronics to homeware and toys.

Employing Mindfulness Tactics

Practicing mindful spending can have a profound impact on your financial health. Mindfulness allows you to focus on what you truly need based on your financial goals and values.

- Start by focusing on needs over wants, and learning to differentiate between the two.

- Implement a cooling-off period for purchases, especially big ticket items. This allows time to ponder over the necessity of the item.

- Using meditation and other mindfulness techniques can also help control spending. These practices encourage greater self-awareness and self-control.

Understanding Impulse Spending

Impulse spending is buying things you hadn’t planned to purchase. It usually happens when we allow our emotions or the delicate persuasion techniques of marketers to influence our buying decisions, rather than sticking to a budget or shopping list.

Causes and triggers of impulse spending can range from emotional responses like stress or boredom to external factors such as sales promotions. When we see a ‘limited time offer’, our fear of missing out can silence the logical part of our brains that knows we don’t need the item.

There is a direct relationship between emotions and impulse spending. Emotions such as happiness, sadness, and even excitement can trigger the urge to splurge. Recognizing these triggers is crucial in curbing impulse spending.

The impacts of impulsive spending on financial health can be significant. It can lead to spiraling debt, financial stress and inability to meet long-term financial goals.

Pro Tip: Keep a spending diary for a month. This will help in identification of personal impulse spending patterns. You’d be surprised at how often you make unplanned purchases, and the circumstances surrounding these purchases! Once you spot your triggers, you can work on strategies to overcome them.

Recognizing the warning signs of emotional spending, like shopping when you’re upset or buying things to celebrate even minor victories, is a significant step toward better financial health.

Creating a Practical Budget

Creating a realistic budget is like drawing a financial roadmap. It starts with understanding income and expenditure. Know exactly how much money you bring in monthly and cognize where it gets spent.

By prioritizing different expense categories, you get a clearer picture of your spending habits. This involves distinguishing between needs (like rent and groceries) and wants (like a designer handbag).

It’s essential to allocate a set amount for discretionary spending. This gives you the freedom to enjoy your money without straying from your budget. However, stick to the limit you’ve set.

Like your health, monitoring and adjusting the budget is vital. It’s important to review it regularly to ensure it’s still suitable and make necessary adjustments.

Employing Mindfulness Tactics

Practicing conscious spending means being fully aware of what you’re buying, why you’re buying it, and how it influences your financial health. It helps enormously with focusing on needs over wants.

A useful tactic is implementing a cooling-off period before making purchases. Give yourself a set period (say 24 hours) to consider whether you really need that item. Often, you’ll find the impulse to buy has passed.

Using meditation and other mindfulness techniques to control spending can also be helpful. This promotes calm, non-reactive awareness of your thoughts and feelings, which can decrease impulse buying.

Embracing Minimalism

Minimalism is more than just a design aesthetic; it’s a lifestyle philosophy that encourages us to live with less. It’s about appreciating the beauty in simplicity and finding contentment with what we have.

- Understanding the principles of minimalism: Minimalism is all about intentional living. It involves distinguishing between need and want, choosing quality over quantity, and appreciating the value of owning fewer things.

Pro tip: Start by decluttering one area of your life at a time; it can be as simple as cleaning your workspace or purging your wardrobe of clothes you no longer wear.

- How minimalism can help curb impulse spending: By adopting a minimalist mindset, you can resist the urge to make unnecessary purchases. It allows you to be more mindful of your spending, as you prioritize essential items over non-essential ones.

Pro tip: Ask yourself if the item brings value to your life or if it’s merely satisfying a temporary desire every time you’re tempted to purchase something.

- Tips for transitioning to a minimalist lifestyle: Start slow and set achievable goals. Declutter one area at a time, donate items that no longer serve you, and gradually shift your spending habits from quantity-driven to quality-driven.

Pro tip: Connect with others on the same journey. Online communities on platforms like Reddit and Facebook can offer support and inspiration.

- Avoiding the pressures of consumerism: With advertising messages bombarding us from all directions, resisting consumerism can be challenging. However, by staying committed to the principles of minimalism, you can navigate these pressures.

Pro tip: Limit your exposure to advertising. This could mean cutting down on your use of social media, or using ad-blockers on your devices.

Shopping Strategies to Avoid Impulse Buying

Changing how you shop can play a big part in curbing impulse spending. By establishing some ground rules and adopting a more mindful approach, you can keep your spending under control.

- Developing a plan before you shop: Planning helps you steer clear of non-essential purchases. This could involve creating a shopping list or setting a budget for your shopping trip.

Pro tip: Make your plan concrete by writing it down. Having a physical reminder can help you stay on track.

- Shopping with a list and sticking to it: A shopping list is a useful tool to control your spending. It serves as a reminder of what you actually need and reduces the chance of unplanned purchases.

Pro tip: Use a list-making app on your phone for easy access and updates.

- Avoiding sales and marketing triggers: Sales and promotional offers can be tempting, but they often lead to impulse purchases. By avoiding these triggers, you can spend more consciously.

Pro tip: Unsubscribe from marketing emails and notifications to minimize temptations.

- Shopping without a credit card: The convenience of credit cards can often lead to overspending. Try shopping with cash or a debit card to keep your spending in check.

Pro tip: Leave your credit card at home. This can help you avoid unnecessary purchases on the spur of the moment.

Dealing with Financial Stress

Financial stress can lead to impulsive spending, creating a vicious cycle. By recognizing and addressing this stress, you can break the cycle and regain control over your finances.

- Understanding the link between stress and impulsive spending: Stress can drive people to seek instant gratification, which can often take the form of impulsive spending. Recognizing this link is the first step to breaking the cycle.

Pro tip: Try to recognize your unique stress triggers. Awareness can help you manage your reactions better.

- Identifying stressors and developing coping strategies: Identify the specific issues causing financial stress in your life and develop coping strategies for them. This could involve speaking to a financial advisor or adopting stress management techniques like mindfulness and yoga.

- Practicing self-care to reduce financial stress: Incorporating self-care activities into your routine can help manage your stress levels. These activities can range from regular exercise, maintaining a balanced diet, to ensuring you get enough sleep.

- Finding non-material ways to reward yourself: Instead of shopping, find other ways to treat yourself. This could be enjoying a walk in the park, reading a good book, or spending quality time with loved ones.

Adopting these strategies can help you curb impulse spending and maintain a healthy relationship with money. Remember, change takes time and patience, so don’t be too hard on yourself if you falter. Keep your financial goals in sight, and be consistent in your efforts. Over time, you’ll develop healthier spending habits and achieve a sense of financial well-being.