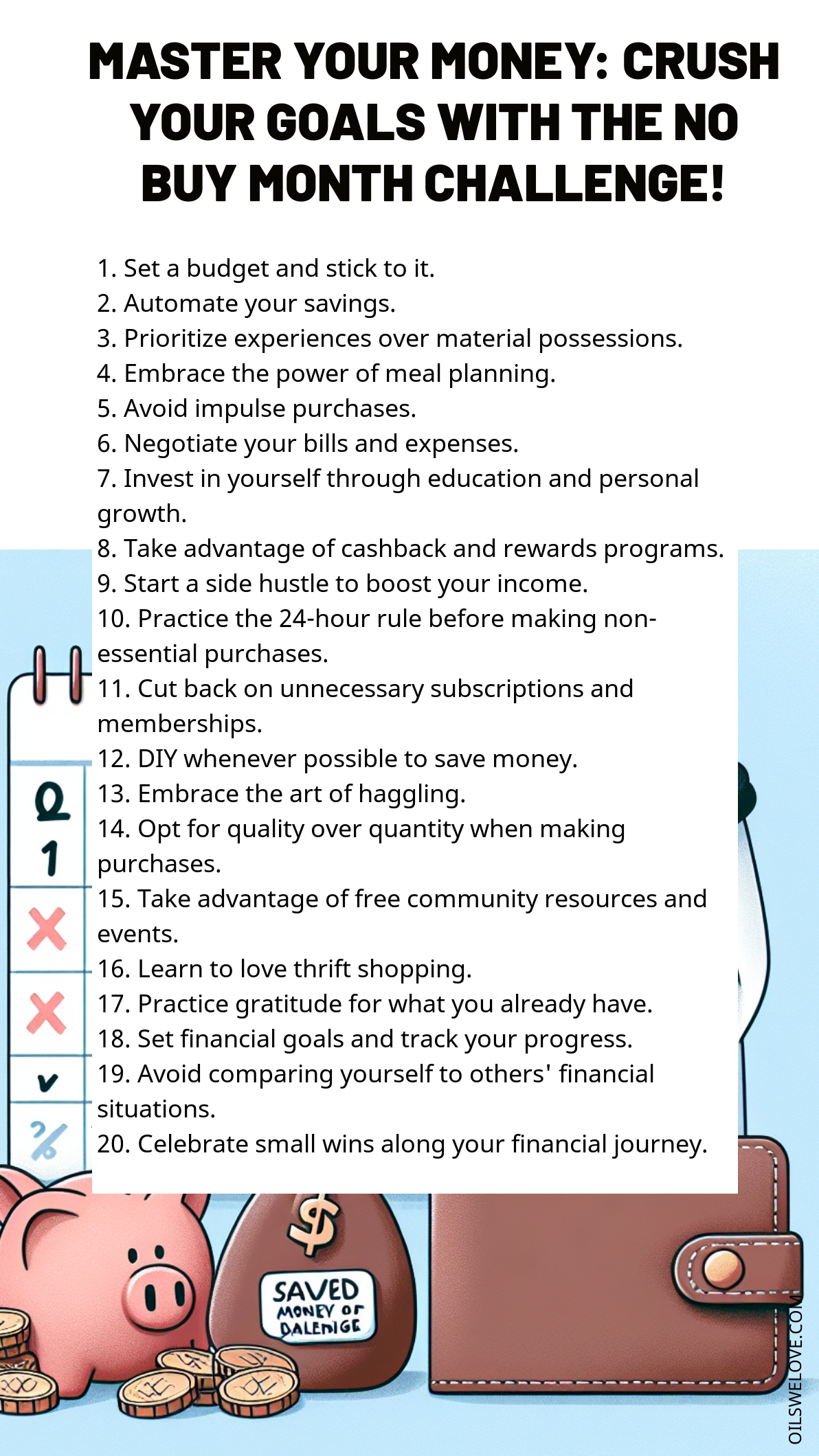

If you are on a mission to save money but are finding it difficult, why not consider the No Buy Month Challenge? This strategic approach to financial management involves several steps, and can dramatically improve both your budgeting skills and your bank balance.

Key Steps in the No Buy Month Challenge

- Set a budget and stick to it: This is the foundation of your financial success. By deciding on your monthly expenses in advance, you will have total control over your finances, ensuring there are no nasty surprises at the end of the month.

- Automate your savings: Automatic transfers ensure that a portion of your income goes straight into your savings, a crucial part of securing a stable financial future.

- Embrace the power of meal planning: By planning your meals in advance, you can save a significant amount of money that might otherwise be spent on unplanned, expensive meals.

Further Tips for Success

- Practice the 24-hour rule: Waiting 24 hours before making non-essential purchases can curb regrettable impulse purchases.

- Take advantage of cashback and rewards programs: Using these programs can save you a significant amount of money over time. They could turn every purchase into a small win for your finances.

- Celebrate small wins: One key to maintaining motivation along your financial journey is celebrating small wins, no matter how small they may seem. Your progressive steps are worth the applause.

The No Buy Month Challenge is an effective way to leverage your earnings and secure a solid financial future. With dedication, you can transform your financial habits step by step, becoming more conscious in your spending and saving.

Reflections on Effective Money Management Strategies

Managing money can sometimes feel overwhelming. However, understanding and implementing effective strategies can not only help you manage your finances but also promote financial well-being. Here are some reflections on twenty popular money management strategies that can cover a spectrum of financial aspects, from budgeting to savings, and from making informed buying decisions to personal wealth creation.

1. Set a budget and stick to it

Commitment is at the heart of absolving ourselves from the cycle of impulsive buying and overspending. Setting a budget provides a structured way to track income and expenses, helping us gain control over our financial life. But what really turns the tide is our ability to stick to the budget!

2. Automate your savings

Thanks to modern technology, one can automate savings, which means every time you receive your payment, a part of it automatically goes into your savings account. It’s an effortless way to ensure that the savings are not compromised, while also fostering a disciplined approach towards money management.

3. Prioritize experiences over material possessions

Material possessions may lose value over time, but the joy and learning from experiences tend to enrich us for a lifetime. By prioritizing experiences over possessions, we make a conscious choice of investing in personal growth and happiness.

4. Embrace the power of meal planning

Meal planning can drastically cut down food waste and dining out expenses. Plus, it brings a positive change in our eating habits, steering us towards a healthier lifestyle.

5. Celebrate small wins along your financial journey.

Small wins keep us motivated. Whether it is sticking to a budget, reaching a saving goal, or not making an impulsive purchase, every small success deserves to be celebrated. It fosters a positive and proactive attitude towards financial management.

Remember, financial management is not about restricting, instead, it provides a framework that enables us to achieve our goals while living a fulfilling life. So, embark on this journey with a positive mind, always learning and adapting to the dynamic aspects of personal finance.